Inventory Turnover Ratio: This ratio shows how a company can convert its inventories into cash. Receivables Turnover Ratio = Revenue / Trade Receivable It is mathematically represented as revenue divided by trade receivables. Receivables Turnover Ratio: This ratio indicates how quickly a company can collect its receivables. Some of the major activity ratios are discussed below. Interest Coverage Ratio = EBITDA / Interest ExpenseĪctivity Ratio: These ratios assess a company’s ability to utilize available assets efficiently. It is mathematically represented as earnings before interest, tax, depreciation & amortization (EBITDA) divided by interest expense. Interest Coverage Ratio: This ratio indicates the capability of a company to pay off its financial expenses or interest obligations. It is mathematically represented as total debt divided by total assets.ĭebt-to-Asset Ratio = Total Debt / Total Assets It is mathematically represented as total debt divided by total equity.ĭebt-to-Equity Ratio = Total Debt / Total Equityĭebt-to-Asset Ratio: This ratio shows what percentage of the company’s assets are funded through debt financing. Some of the major leverage ratios are discussed below.ĭebt-to-Equity Ratio: This ratio indicates the capital structure, which shows the company’s dependency on the debt fund vis-à-vis its fund. Leverage Ratio: These ratios assess a company’s capital structure.

#RECEIVABLES TURNOVER RATIO FORMULA EXCEL PLUS#

It is mathematically represented as cash & cash equivalents plus marketable securities divided by current liabilities.Ĭash Ratio = (Cash & Cash Equivalents + Marketable Securities) / Current Liabilities Quick Ratio = (Current Assets – Inventories – Prepaid Expenses) / Current LiabilitiesĬash Ratio: This ratio shows the percentage of the short-term liabilities covered by the most liquid assets (cash and other liquid marketable securities).

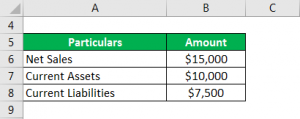

It is mathematically represented as current assets minus inventories and prepaid expenses divided by current liabilities. Quick ratio: This ratio indicates the coverage of the short-term liabilities by the short-term assets, which are easy to liquidate. It is mathematically represented as current assets divided by current liabilities.Ĭurrent Ratio = Current Assets / Current Liabilities Some of the major liquidity ratios are discussed below.Ĭurrent Ratio: This ratio shows how well the short-term assets cover the short-term liabilities in cash, inventories, receivables, etc.

Liquidity Ratio: These ratios indicate the short-term liquidity position of a company. The formula for Accounting Ratio can be calculated by using the following steps:

0 kommentar(er)

0 kommentar(er)